This site is also available in: Deutsch (German)

Digitalization in the banking sector presents financial institutions with a variety of challenges. Customers expect seamless, secure and personalized online banking experiences, while banks struggle with regulatory requirements, technological innovations and the integration of existing systems. One of the leading technologies to address these challenges is the Avaloq Front Platform (AFP), in particular through the use of Banklets.

The challenge: complexity and flexibility in digital banking

The provision of modern e-banking solutions requires a platform that is both flexible and secure. Banks face the following challenges:

- Adaptability: Customers expect tailor-made digital experiences that can be quickly adapted to new market trends.

- Security & compliance: Regulations and data protection requirements are constantly increasing and require robust security mechanisms.

- Technical integration: Banks need to connect existing legacy systems with modern front-end technologies.

- Fast development cycles: Competition requires shorter development and implementation times for new functions.

The solution: Banklets as a key component of the Avaloq Front Platform

Banklets are modular front-end components that build on the Avaloq Front Platform and enable financial institutions to implement new digital functions quickly, flexibly and securely. They can be seamlessly integrated into the existing Avaloq Web Banking environment and offer the following advantages:

- Customized design: Banks can use banklets to expand their digital offerings in a customized way.

- Fast time to market: Banklets enable agile development and integration of new features.

- High security standards: Avaloq ensures that banklets meet regulatory requirements.

- Easy integration: Thanks to an API-supported architecture, banklets can be easily connected to existing systems.

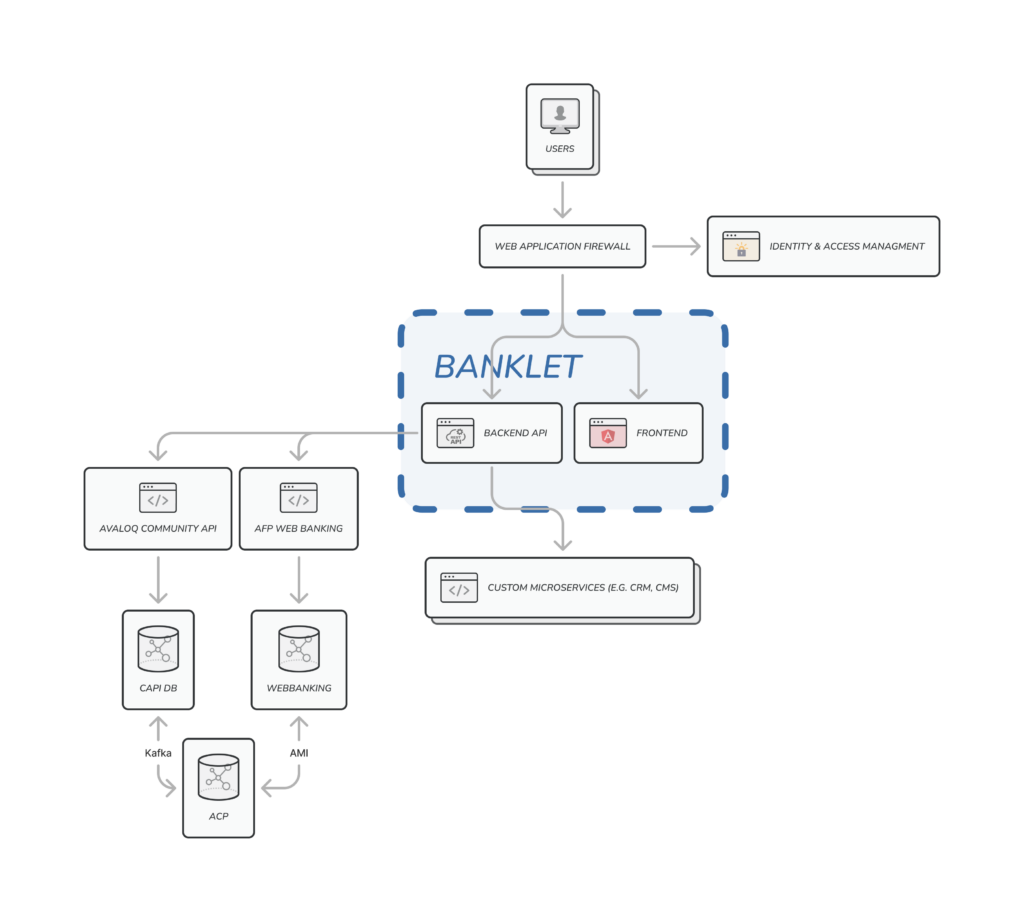

Technical architecture of the Avaloq Front Platform with banklets

The Avaloq Front Platform is based on a modern microservices architecture with RESTful APIs to enable flexible and extensible system integration. The main components include:

- UI-SDK: A software development kit based on Angular that ensures a uniform user interface and enables seamless integration of banklets.

- Banklet API: A central interface for communication between frontend and backend, based on Java/Spring Boot.

- Security & Compliance: Through strict security standards and regulatory compliance, Avaloq ensures that data integrity and the protection of client data remain guaranteed.

Development and provision of banklets

The implementation of banklets requires comprehensive expertise in the areas of full-stack development, CI/CD automation and test automation. Modern DevOps approaches make it possible to develop and test new features efficiently. These are particularly important:

- Local development environments with fast feedback loops

- Automated tests at all levels (unit, integration, end-to-end)

- Continuous Integration & Deployment (CI/CD)

- Containerization with Kubernetes or OpenShift

Conclusion: Banklets as pioneers for digital banking

The Avaloq Front Platform with Banklets offers a powerful solution for banks that need a modern, secure and customizable e-banking environment. With its modular architecture and API-first approach, Banklets enable fast and efficient development of digital banking services. Banks that want to optimize their digital processes and offer their customers an outstanding online banking experience will benefit significantly from the possibilities of this technology. Banklets help to overcome current challenges in digital banking and enable future innovations.